Virtual Intelligent

Tax Advisor

Simplify Your Tax Compliance and E-Invoicing with VITA’s Innovative Tax Automation Solution

Built by Tax Experts for Business Owners, CFO’s and CPA’s to simplify tax compliance.

Simplify Your Tax Compliance and E-Invoicing with VITA’s Innovative Tax Automation Solution

Built by Tax Experts for Business Owners, CFO’s and CPA’s to simplify tax compliance.

VITA’s all-in-one software solution automates and simplifies tax compliance, so you can focus on what really matters – your business.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

ZATCA Announces the 17th Wave Criteria for Phase 2 E-Invoicing Integration

Based on the latest announcements, the ZATCA will begin…

Guidelines on transactions with Related Parties for Zakat

The General Authority for Zakat and Tax (ZATCA) has issue guidelines on the zakat…

New income tax legislations

Amidst the recent amendments and proposed changes on the current tax and …

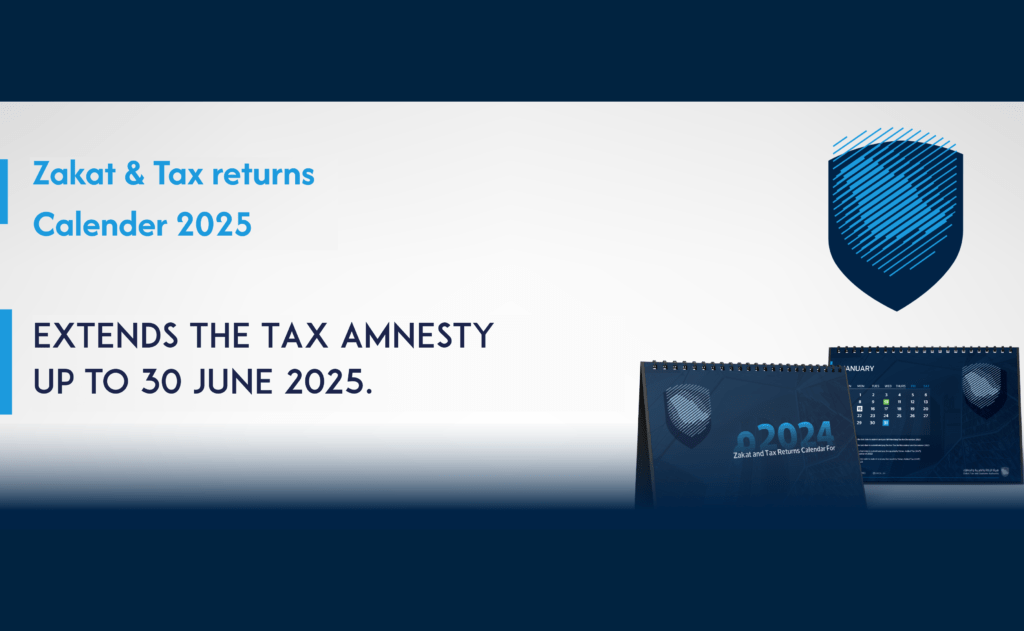

ZATCA extends the Tax Amnesty up to 30 June 2025.

On 29 December 2023, the Zakat, Tax and Customs Authority (ZATCA) announced …

Incisive & Insightful Dashboards to provide Business Owners / CFOs / CPA for visibility on compliance tax liability, leakages due to unclaimable input benefits, overview of other critical business indicators on a virtual basis.

Provides flexibility to custom define variety of reports, in addition to the standard reports.

Easy integration with your existing ERP / POS software through API, CSV or 3rd party integration for all E-Invoice transactions.

Convert your current invoice format/structure into ZATCA compliant E-Invoice documents with ease.

An end-to-end solution offers a single ERP add-on that handles all Phase II requirements and integrates with ZATCA backend system.

With embedded intelligence in the system, tax compliance, data residency and data security objectives of KSA are addressed.

Internal data controls offer freedom to decide on the level and complexity of validations to suit the business operations.

VITA suite has been developed by leading industry tax professionals to offer a comprehensive integrated intelligent tax compliance solution.

VITA utilizes A.I to ensure tax rule compliance, reducing errors and chances of penalities.

Simplifies tax authority audit procedures, ensuring audit compliance.

Reduces resources spent on compliance tasks, allowing businesses to focus on operations.

VITA makes tax adherence cost-effective, saving time and money for businesses.

Client Centric Approach: We listen, understand unique business needs and tailor our tax technology solutions for client success.